Monetary Policy Review: RBI keeps Repo Rate Steady at 6.5% Fifth Time

STORIES, ANALYSES, EXPERT VIEWS

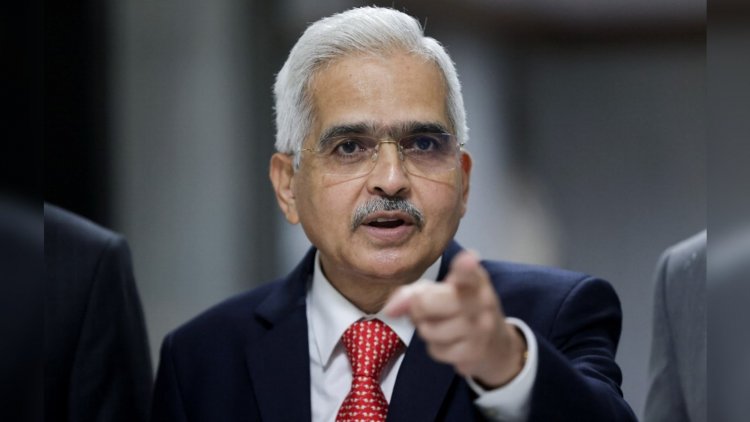

The Reserve Bank of India Friday kept the policy rate unchanged at 6.5% for the fifth time as it maintains a tight vigil on inflation.

“The Reserve Bank of India’s Monetary Policy Committee (MPC) after a detailed assessment of the evolving macroeconomic developments, has decided unanimously to keep the repo rate unchanged at 6.5%,” RBI Governor Shaktikanta Das said amid India’s better-than-expected economic growth.

The RBI had raised the repo rate by a total 250 basis points (bps) since May 2022 in efforts to cool surging inflation, which dropped to a four-month low of 4.87% in October, but is expected to remain above the RBI’s 4% medium-term target for some time.

Inflation forecast unchanged

The RBI also kept the inflation forecast unchanged as it projected Consumer Price Index (CPI)-based inflation, or retail inflation, at 5.4 per cent for FY24, with Q3 projection at 5.6 per cent and Q4 projection at 5.2 per cent.

CPI inflation for Q1FY25 is projected at 5.2 per cent, for Q2 at 4 per cent and for Q3 at 4.7 per cent.

"We have made significant progress in bringing down inflation to below 5 per cent in October 2023 despite occasional blips due to intermittent supply shocks. Our policy of prioritising inflation over growth, hiking policy rate by 250 basis points in a calibrated manner and draining out excess liquidity have worked well, alongside supply-side measures taken by the government, to bring about this disinflation," Das said.

“Notwithstanding this progress, the target of 4 per cent CPI is yet to be reached and we have to stay the course. Headline inflation continues to be volatile due to multiple supply-side shocks which have become more frequent and intense. The trajectory of food inflation needs to be closely monitored. Amid these uncertainties, monetary policy has to remain actively disinflationary to ensure a durable alignment of headline inflation to the target rate of 4 per cent, while supporting growth," Das said.

Optimistic growth forecast

The RBI raised its real GDP growth projection for FY24 to 7 per cent from 6.5 per cent earlier with Q3 GDP at 6.5 per cent (against the estimates of 6 per cent earlier) and Q4 GDP at 6 per cent (against the estimates of 5.7 per cent earlier).

The FY24 growth projection of the RBI is slightly higher than the 6.8 per cent expectation of many economists.

The real GDP growth projection of the RBI for Q1FY25 is at 6.7 per cent, for Q2FY25 is at 6.5 per cent and for Q3FY25 is at 6.4 per cent.

Framework for connected lending

Governor Das said that the extant guidelines on connected lending are limited in scope. So the RBI has decided to come out with a unified regulatory framework on connected lending for all regulated entities of the Reserve Bank.

"This will further strengthen the pricing and management of credit by regulated entities," said Das.

SDF, MSF allowed even on weekends, holidays

RBI decided to allow the reversal of liquidity facilities under both SDF (Standing Deposit Facility) and MSF (Marginal Standing Facility) even during weekends and holidays with effect from December 30, 2023.

"It is expected that this measure will facilitate better fund management by the banks. This measure will be reviewed after six months or earlier if needed," said RBI Governor Das.

The MSF (Marginal Standing Facility) is like an emergency option provided by the Reserve Bank of India for banks. It helps banks get money overnight when they can't borrow from other banks. So, if banks run out of money to lend to each other, they can still get some from the Reserve Bank of India through MSF.

On the other hand, SDF is a way for banks to safely store any extra money they have for a short period.

Enhanced UPI transaction limit for specified categories

The RBI proposed to enhance the UPI transaction limit for payment to hospitals and educational institutions from ₹1 lakh to ₹5 lakh per transaction.

“This will help the consumers to make UPI payments of higher amounts for education and healthcare purposes," Das said.

Changes in e-mandate limit for specified categories

Under the e-mandate framework, an additional factor of authentication (AFA) is currently required for recurring transactions exceeding ₹15,000. The RBI proposed to enhance this limit to ₹1 lakh per transaction for recurring payments of mutual fund subscriptions, insurance premium subscriptions and credit card repayments.